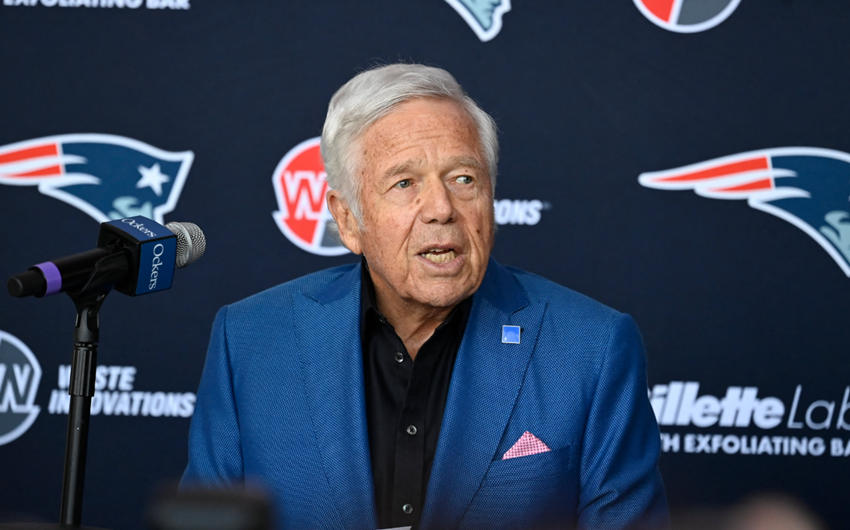

Robert Kraft Net Worth In 2026: How The Patriots Empire Made Him A Billionaire

If you’re searching Robert Kraft net worth, you’re really asking a bigger question: how did the owner of the New England Patriots turn a football team into a massive, multi-industry empire? The short answer is that Kraft’s wealth comes from a combination of private business success and one of the smartest sports investments of all time. In 2026, Robert Kraft’s net worth is widely estimated in the $10 billion to $15 billion range, with many figures landing around the mid-$13 billion mark.

That number isn’t just “NFL owner rich.” It reflects decades of business building, valuable sports assets, real estate development, and the explosive rise in NFL franchise valuations.

Quick Facts About Robert Kraft

- Full name: Robert Kenneth Kraft

- Born: June 5, 1941

- Known for: Owner of the New England Patriots

- Business role: Chairman and CEO of The Kraft Group

- Major sports assets: Patriots, New England Revolution, Gillette Stadium operations

- Estimated net worth (2026): Roughly $10B–$15B

Robert Kraft Net Worth In 2026 A Realistic Range

In 2026, Robert Kraft’s net worth is most realistically estimated around $10 billion to $15 billion. You’ll see different numbers online, but that range makes sense because so much of his wealth is asset-based:

- the value of the Patriots franchise (which changes as the market changes)

- the value of other sports and stadium-related holdings

- private Kraft Group businesses that aren’t publicly traded

- real estate and long-term development projects

So even if his day-to-day lifestyle looks the same, the “net worth” estimate can rise or fall depending on how analysts value his assets in a given year.

The Patriots Are The Asset That Supercharged His Wealth

Robert Kraft bought the New England Patriots in 1994, and that purchase became the kind of investment that changes everything. NFL franchise values have climbed dramatically over the last few decades, and the Patriots are consistently ranked among the league’s most valuable teams.

When a franchise becomes that valuable, it changes the owner’s net worth even if the owner never sells. That’s how billionaire math works: your wealth can grow because your assets grow in value on paper.

But the Patriots aren’t just a team. They’re a revenue platform that earns from multiple directions:

- NFL revenue streams: media rights, licensing, league partnerships

- Team revenue: tickets, premium seating, suites, sponsorships

- Merchandise: branded products and licensing deals

- Local business ecosystem: game-day traffic and year-round tourism

All of that increases the franchise’s market value, and that rising market value is a major reason Kraft’s net worth sits in the multi-billion range.

The Kraft Group The Real Engine Behind The Fortune

Football is what most people associate with Kraft, but his wealth story started long before the Patriots became a dynasty. The deeper foundation is The Kraft Group, his private holding company with interests that extend beyond sports.

The Kraft Group has long been associated with industries like:

- paper and packaging

- manufacturing and distribution

- sports and entertainment operations

- real estate and development projects tied to stadium growth

This matters because it means Kraft’s wealth isn’t dependent on whether the Patriots have a winning season. The sports side is huge, but it’s supported by a broader business machine that generates long-term cash flow and stability.

How Robert Kraft Made Money Before He Became A Sports Owner

Like many billionaires, Kraft built his fortune in what some people would call “boring” industries—because boring industries often generate the most reliable cash flow. Paper, packaging, and distribution can be highly profitable at scale, especially when managed well over decades.

That early business success gave him the power to do bigger things later, including purchasing iconic assets like an NFL franchise. It’s a common billionaire pattern:

- build cash-flow businesses first

- use that stability to invest in higher-profile assets later

- let those assets appreciate massively over time

The Patriots purchase was the visible move. The private business base made it possible.

Gillette Stadium And Why Venue Control Is A Big Deal

Owning a team is valuable. Owning the stadium operations around it can be even more valuable—because a stadium can earn money year-round, not just on Sundays.

Venue control can generate revenue through:

- concerts and major events

- premium seating and corporate hospitality

- stadium naming rights and sponsorship zones

- food, beverage, and retail revenue

- tourism and event-driven traffic

That’s why many owners focus on “team + venue + development.” It creates an ecosystem that produces income regardless of the team’s record.

Patriot Place And The Power Of Sports Real Estate

Sports ownership becomes far more profitable when it’s paired with real estate development. When fans show up for games, they also spend money outside the stadium—restaurants, shopping, hotels, and experiences.

By building a surrounding district tied to the venue, owners can capture more of the economic activity that a team generates. That’s why stadium-area development is such a big wealth driver for modern sports empires.

Even if you don’t follow the details of every project, the strategy is straightforward: turn game-day traffic into a year-round destination.

The New England Revolution And Expanding The Sports Portfolio

Kraft’s sports portfolio isn’t just the Patriots. Owning the New England Revolution adds another franchise asset and another revenue stream. It also adds long-term upside, because soccer’s growth in the U.S. has increased interest in MLS teams over time.

When billionaires build sports wealth, they often think in portfolios:

- multiple teams

- shared infrastructure

- shared sponsorship relationships

- shared venue operations

This kind of synergy helps protect wealth and increases the value of the overall sports business platform.

Why Robert Kraft’s Net Worth Can Increase Without Selling Anything

This is where people get confused about billionaire net worth. Kraft doesn’t need to “cash out” to get richer on paper. His net worth can rise simply because the assets he owns are valued higher each year.

The biggest drivers of that upward pressure are:

- NFL franchise appreciation: teams keep rising in value due to media rights and global demand

- league-wide revenue growth: bigger TV and streaming deals increase every team’s worth

- stadium and event revenue: year-round operations add stability and profit

- real estate development: surrounding properties can become major long-term assets

- private business growth: Kraft Group companies can keep compounding quietly

So even in a “quiet year,” a billionaire owner can see net worth rise by hundreds of millions if market valuations move upward.

Is His Wealth Mostly Cash Or Mostly Assets?

For someone like Kraft, most wealth isn’t sitting in cash. It’s tied up in assets that would be worth massive amounts if sold. That usually includes:

- ownership stakes in sports franchises and private companies

- real estate linked to venue development and private holdings

- operating businesses that generate cash flow

- long-term investments that increase in value over time

That’s why net worth discussions can feel abstract. Billionaire wealth is often about ownership and valuation, not just cash in the bank.

Why Net Worth Estimates Vary So Much

Even when most sources agree Kraft is worth tens of billions, the exact number can swing because:

- sports franchises don’t trade daily like stocks, so valuations differ

- private companies are hard to price without public financials

- real estate values change with market cycles

- debt and financing structures can impact “net” wealth calculations

This is why a realistic range is more useful than pretending one exact number is perfect.

The Bottom Line

Robert Kraft net worth in 2026 is most realistically estimated around $10 billion to $15 billion, with many figures landing near the mid-$13 billion range. He built that fortune through decades of private business growth and then multiplied it through one of the smartest sports investments ever: buying the Patriots and turning that ownership into a full ecosystem of team value, stadium revenue, and surrounding development.

If you want the simplest takeaway: Kraft isn’t wealthy just because he owns a football team—he’s wealthy because he owns a business platform that turns sports into long-term compounding value.

Featured image source: https://www.cnbc.com/2026/02/03/patriots-owner-robert-kraft-hall-of-fame.html