Larry Silverstein Net Worth In 2026: Silverstein Properties, WTC, And Real Estate Wealth

If you’re researching Larry Silverstein net worth, you’re looking at a fortune that doesn’t sit neatly in a single bank account. His wealth is mostly tied up in New York City real estate—office towers, long-term leases, development rights, and the kind of complex financing structures that make “one exact number” hard to pin down. In 2026, estimates commonly place him in the billionaire range, but the public figures you’ll see can vary widely.

Quick Facts

- Full Name: Larry A. Silverstein

- Born: May 30, 1931 (New York City, New York)

- Age In 2026: 94

- Occupation: Real estate developer; Chairman of Silverstein Properties

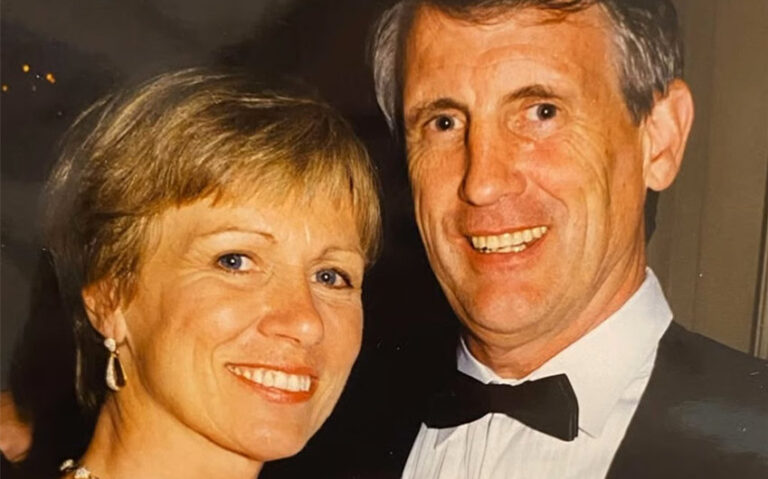

- Spouse: Klara Silverstein (married in 1956)

- Children: Three

- Best Known For: Major Manhattan real estate holdings and the rebuilt World Trade Center development role

- Estimated Net Worth (2026): Commonly discussed as roughly $1B–$4B depending on the methodology

Who Is Larry Silverstein?

Larry Silverstein is an American real estate developer and the longtime leader of Silverstein Properties, a major New York City real estate company known for office and residential towers. Born on May 30, 1931, in New York City, he built his career in a business that rewards patience: long-term leases, steady cash flow, property appreciation, and strategic redevelopment. Over decades, he became one of Manhattan’s most influential commercial landlords and developers.

Bio-wise, Silverstein is often recognized for two things at once: his deep portfolio of Manhattan buildings and his role in the redevelopment of the World Trade Center site. He’s also known as a family man—married to Klara Silverstein since 1956—and he has three children. In 2026, he remains a prominent name in U.S. real estate, with wealth that’s primarily tied to property value, partnership stakes, and the performance of large-scale developments.

Larry Silverstein Net Worth In 2026

In 2026, Larry Silverstein’s net worth is most often described in the billionaire range. Depending on which outlet you read (and how they value private real estate holdings), you’ll see estimates spanning roughly $1 billion to $4 billion.

That wide range can feel confusing until you remember how real estate wealth works. His money isn’t like a celebrity’s “salary and endorsement” story. It’s more like a constantly moving balance sheet:

- Asset values change (property prices rise and fall with the market).

- Debt is part of the model (major buildings often carry large financing).

- Ownership can be shared (partnerships, investors, and long-term lease structures affect how much value is “his”).

- Projects have phases (a development can be worth far more after leasing stabilizes).

So, rather than chasing one perfect number, it’s more accurate to say this: Silverstein is very likely a billionaire, and his wealth is primarily concentrated in New York City real estate assets and long-term development interests.

Why Net Worth Estimates Vary So Much

When you search for a real estate billionaire’s net worth, you’re often seeing different “styles” of calculation.

Some estimates focus on conservative, verifiable ownership value

More conservative approaches tend to rely on publicly documented holdings and cautious assumptions about debt and partner equity. This method often lands closer to the lower end of the billionaire range.

Other estimates assume higher valuation and simpler ownership math

Less conservative sites sometimes treat major developments and building portfolios as if they’re fully owned, use optimistic market comps, and minimize the impact of financing and partner stakes. Those approaches can push numbers closer to the upper end of the range.

Both approaches can be “reasonable” in the sense that real estate is not transparent like public stock. But the reality is that his true net worth is a moving target shaped by market cycles and deal structures.

The Core Of His Wealth: Silverstein Properties

Silverstein’s financial foundation is the company he built into a serious New York powerhouse. Over the decades, Silverstein Properties became known for:

- owning and managing large commercial buildings

- acquiring properties with long-term upside

- developing high-profile projects that reshape neighborhoods

- leveraging financing in ways typical of top-tier real estate firms

In practical terms, this means his wealth comes from the slow, powerful compounding of real estate: rental income, leasing spreads, property appreciation, and development value creation.

How Larry Silverstein Makes Money

1) Commercial Leasing Income

At the simplest level, major office towers generate revenue through tenants paying rent over long periods. When occupancy is strong and lease rates rise, owners and operators benefit. Even during weaker market moments, long leases can provide stability—especially for well-located assets.

2) Property Management And Operating Fees

Large real estate firms often earn revenue not only from owning buildings, but also from managing them. Managing major properties can bring steady operating income, and it also helps control the performance of the asset over time.

3) Development Profits And “Value Creation”

Development is where fortunes can grow quickly—at least on paper. A building may be worth far less when it’s a plan on a page than when it’s completed, leased, and stabilized. If Silverstein Properties develops, finances, and delivers a project successfully, the value lift can be enormous.

4) Partnership Structures And Long-Term Lease Rights

Some of Silverstein’s most famous projects are tied to long-term agreements rather than simple “buy it outright” ownership. In real estate, long-term leaseholds, development rights, and partnership equity can be just as valuable as deed ownership—sometimes more so, depending on the terms.

5) Refinancing And Capital Strategy

High-level real estate is also a financing game. Owners often refinance buildings as values rise, pulling capital out while retaining control of the asset. This can fund new developments or acquisitions, and it can be a major reason net worth estimates fluctuate: debt and liquidity are part of the strategy.

The World Trade Center Story And Why It Matters Financially

Larry Silverstein is especially known for securing a long-term lease agreement connected to the World Trade Center complex in 2001—an event that placed him at the center of one of the most complex real estate and development sagas in modern American history.

From a net worth standpoint, the WTC involvement matters because it combines several wealth drivers at once:

- scale: the projects are enormous and globally significant

- duration: long-term development and leasing timelines can span decades

- complexity: insurance, financing, public-private agreements, and rebuilding phases affect valuation

- visibility: high-profile projects can unlock new deals and partnerships

Importantly, large-scale redevelopment isn’t just “instant profit.” It can be years of investment, risk, negotiation, and carrying costs before the upside becomes clear. That’s another reason his net worth is difficult to summarize in one number: big projects create big swings on paper depending on where they are in the cycle.

What His Wealth Likely Includes Beyond “Cash”

When you hear “billionaire,” it’s easy to picture a vault of money. Real estate billionaires usually hold wealth in a more layered way:

- equity in buildings (the value after subtracting debt)

- development interests (value that can rise after a project stabilizes)

- cash flow businesses (management operations and related firms)

- personal real estate (high-value homes can be part of the asset picture)

- investment holdings (often private and not widely visible)

So even if his net worth is “$X billion,” much of it is not instantly liquid. It’s wealth that exists in properties and long-term rights—valuable, but not the same as cash you can withdraw on a Tuesday.

What Could Raise Larry Silverstein’s Net Worth Next?

In 2026 and beyond, his net worth can rise if:

- New York commercial real estate rebounds strongly and property values climb

- major projects stabilize with higher occupancy and stronger rent rolls

- financing improves (lower rates can boost valuations and refinancing options)

- additional development phases reach completion and leasing milestones

For real estate moguls, the biggest net worth jumps usually happen when the market turns positive and large projects “graduate” into fully leased, predictable cash-flow assets.

What Could Pull It Down?

On the flip side, net worth can shrink if:

- office demand weakens and leasing spreads compress

- interest rates stay high (which can pressure commercial valuations)

- refinancing becomes harder or more expensive

- project timelines extend and costs rise

This is why you’ll often see billionaire real estate net worth estimates move over time. The market’s mood matters—and so does the cost of capital.

The Bottom Line

In 2026, Larry Silverstein’s net worth is best described as billionaire-level wealth tied primarily to New York City real estate, development interests, and long-term lease structures. Depending on valuation style, public estimates commonly range from about $1B to $4B. The most reliable way to understand his fortune is not as a single “cash number,” but as asset-based wealth that rises and falls with property values, financing conditions, and the performance of massive long-term projects.

Bio Summary

Larry A. Silverstein (born May 30, 1931) is an American real estate developer and the chairman of Silverstein Properties, a major New York City real estate company known for commercial and residential projects. He built his fortune through decades of Manhattan acquisitions, leasing strategy, and large-scale development work, including a major role tied to the rebuilt World Trade Center complex in Lower Manhattan. Married to Klara Silverstein since 1956 and a father of three, he remains one of the best-known figures in modern U.S. real estate. In 2026, Larry Silverstein’s net worth is widely estimated in the billionaire range, driven by property equity, development interests, and long-term real estate value creation.

Featured image source: https://www.foxbusiness.com/business-leaders/rebuilding-the-world-trade-center-18-years-later-and-the-man-behind-it